Intermediary Financing Services

I. Transaction details

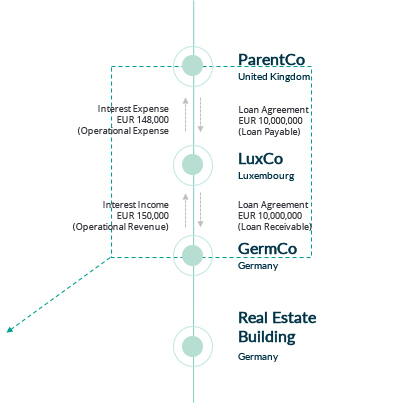

- ParentCo has entered into a Loan Agreement (Loan Payable) with LuxCo for an amount of EUR 10,000,000. In exchange, LuxCo has paid interests expense for an amount of EUR 148,000 (for the first year).

- In turn, LuxCo has entered into a Loan Agreement (Loan Receivable) with GermCo for the same amount. In exchange, LuxCo has received interest income for an amount of EUR 150,000 (for the first year).

II. Characterization of the transactions

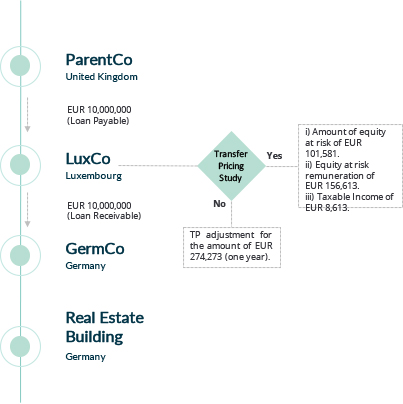

- LuxCo is receiving funds on behalf of GermCo in order to conduct the acquisition of a building located in Germany (investment). Therefore, the transaction should be treated as equivalent to one single incoming and outgoing transaction and considered as intra-group financing services provided by LuxCo to GermCo.

- LuxCo is performing loan origination activities and assuming equity risk on behalf of GermCo. Thus, this transaction is in line with the Transfer Pricing Luxembourg Circular’ requirements, therefore a transfer pricing study should be performed in order to determine the arm’s length remuneration (equity at risk remuneration).