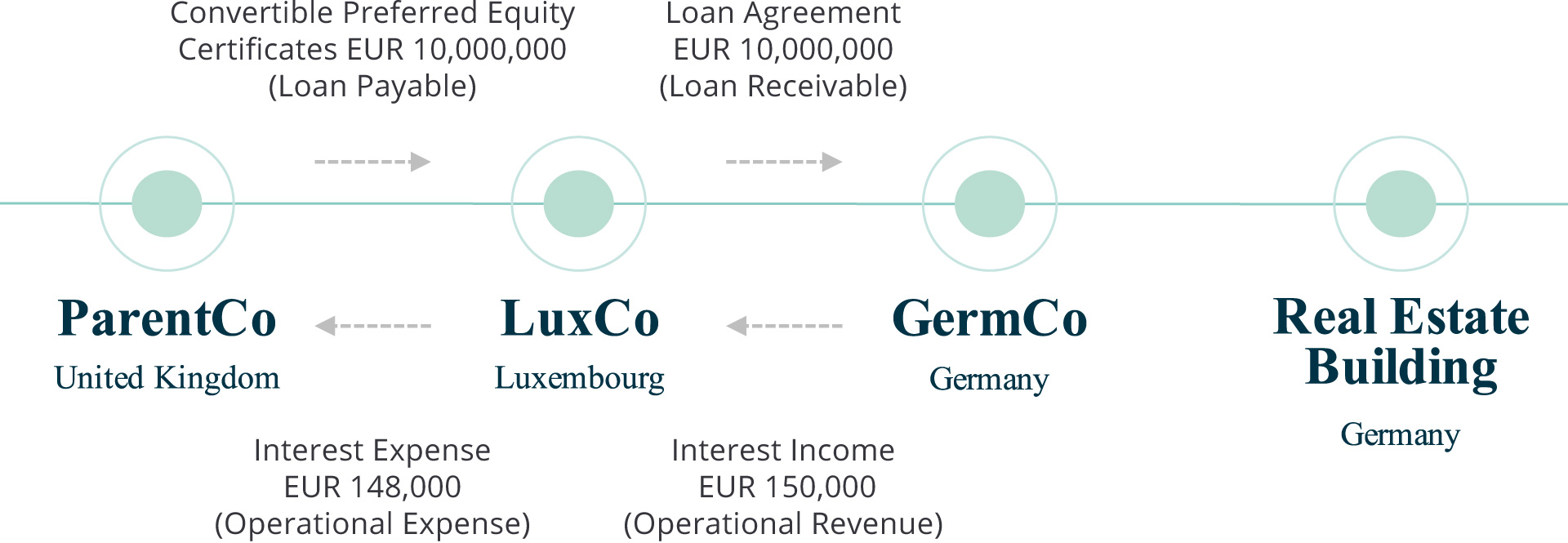

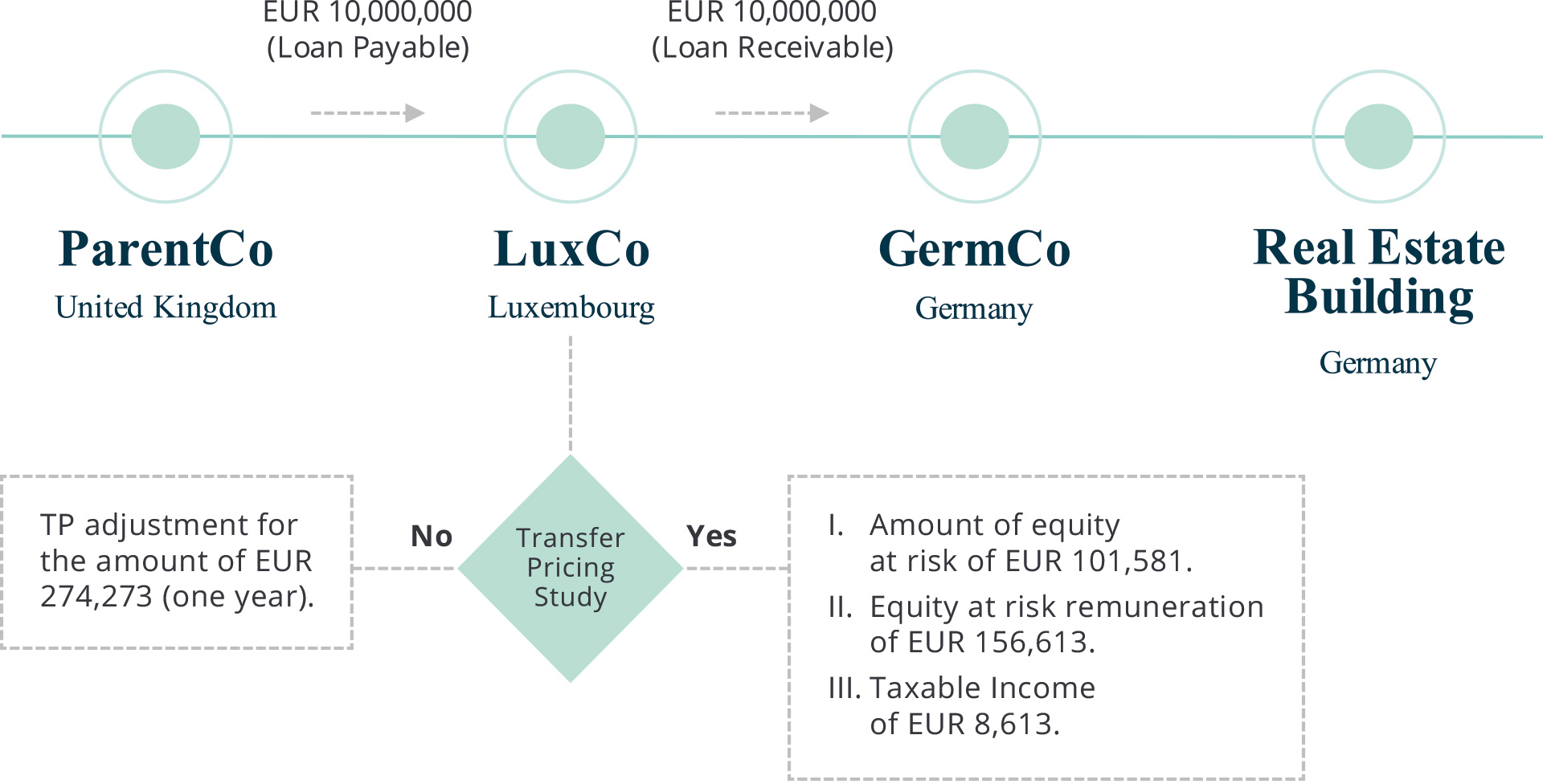

I) Transfer pricing

Pursuant to Paragraph 11 of the preface of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2017:

“transfer prices are those at which an enterprise transfers physical goods and intangible property or provides services to associated enterprises”.