Luxembourg Tax Authorities

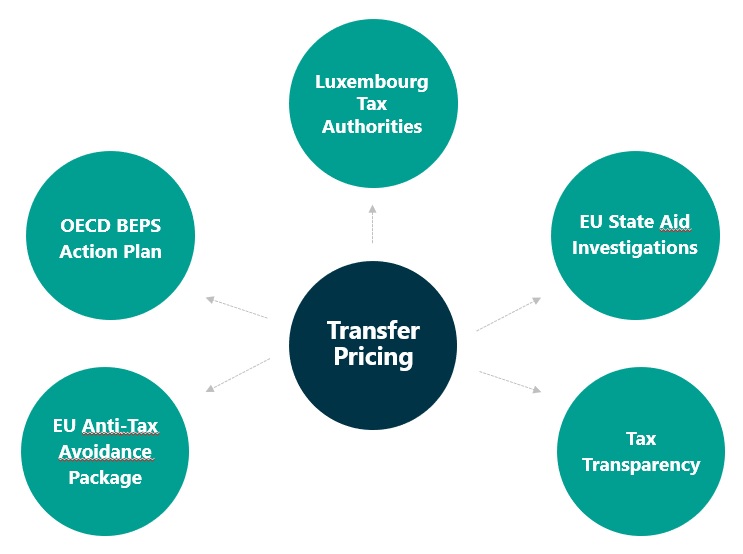

In December 2016, a new Article 56bis was introduced in the Luxembourg Income Tax Law (“LITL”), and a new administrative Circular, L.I.R. 56/1 – 56bis/1, was released. As a consequence of these new transfer pricing regulations, it is important for taxpayer to pay attention to the following points:

- Intercompany transactions:. Paragraph 7 of Article 56bis clarifies the following:

“…transactions between the parties can be disregarded for transfer pricing purposes, if [part of] the transaction does not possess the commercial rationality of arrangements that would be agreed between independent parties…”

The transfer pricing obligation is extended to any type of intercompany transactions, meaning that any taxpayer subject to the provisions of the arm’s length principle in the LITL needs to evidence how the arm’s length price was determined.

- No transfer pricing study or safe harbor: Paragraph 27 of the Circular L.I.R. 56/1 – 56bis/1 states:

“In case the finance company does not have a profile of an intra-group bank, but rather intervenes as an “agent” in a financing transaction, the arm’s length remuneration should be equal to a net income (after taxes) of 2% on the assets financed (i.e. loan agreement)”

- Transfer pricing study: Paragraph 28 of the Circular L.I.R. 56/1 – 56bis/1 states:

“However, the arm’s length remuneration (or safe harbour of 2%) does not apply if a transfer pricing report is prepared, in line with the OECD Guidelines and the Luxembourg Circular, which determines a different return”

No specific form is required by law. However, according to current market practice, i) a simplified transfer pricing analysis can be performed for transactions below EUR 25 million and ii) some integral transfer pricing documentation should be put into place for transactions above the threshold of EUR 25 million. The documentation should be fully aligned with substance requirements, business plan and documents related to the structure.

- No exemption from transfer pricing obligation: There is no exception in the application of the transfer pricing requirements so that they apply to any type of commercial transactions carried out between any related commercial parties.