On February 3, 2025, the Luxembourg tax authorities (LTA) issued Circular L.I.R. 164/1, replacing the 1998 circular on the determination of interest rates for debit current accounts held by shareholders or partners of entities subject to corporate income tax.[1] This update introduces new benchmarks for market-based interest rates and strengthens the performance of transfer pricing documentation, particularly in relation to the treatment of shareholder and intra-group current accounts.

The revised circular is particularly relevant for companies with shareholder or partner debit current accounts, entities engaged in intra-group financing or treasury activities, and businesses subject to Luxembourg corporate income tax.[2] In cases where the LTA identifies inconsistencies or inadequate documentation, companies may face administrative penalties, financial adjustments, or even legal consequences.

This article provides an analysis of the transfer pricing compliance process, new regulatory considerations for Shareholder and Intra-Group Accounts, the Transfer Pricing assessment and dispute process in Luxembourg and overview of recent transfer pricing court cases in Luxembourg.

- The Transfer Pricing Compliance Process in Luxembourg

Luxembourg’s transfer pricing framework is outlined in Article 56 and 56bis of the Luxembourg Income Tax Law (LITL), §171 of the Luxembourg Tax Code, and Circular L.I.R. No. 56/1-56-bis/1 (the “Transfer Pricing Circular”). These rules establish that all transactions between a Luxembourg company and associated enterprises must adhere to arm’s length market conditions, including those involving business restructurings.[3] To that end, a transfer pricing analysis must be prepared following the Transfer Pricing Circular and the latest OECD Transfer Pricing Guidelines.[4]

Unlike other jurisdictions where transfer pricing documentation must be submitted alongside tax returns, in Luxembourg, businesses are not required to submit documentation proactively but must maintain it and provide it upon request.[5] Furthermore, taxpayers must indicate within their annual corporate income tax return whether they engage in intra-group transactions, regardless of their nature or amount. This disclosure obligation requires the attachment of an appendix demonstrating the application of the arm’s length principle in intercompany transactions, ensuring compliance with §171 of the Luxembourg Tax Code.

Many businesses assume that once their transfer pricing documentation is prepared and tax returns are filed, they have fulfilled their obligations. However, transfer pricing compliance is a continuous process. The LTA can reassess tax returns until the tax assessment is issued and until the statute of limitations expires, which is generally five years but may extend to ten years in cases of non-declaration or inaccurate reporting, regardless of fraudulent intent.[6]

- New regulatory considerations for Shareholder and Intra-Group Current Accounts

The new Circular L.I.R. 164/1 provides specific guidance on how interest rates should be determined for debit current accounts, distinguishing between cases where the shareholder or partner is a natural person or a related enterprise.[7]

- The shareholder or partner is a natural person

For individual shareholders or partners, interest rates must align with market rates, and companies may refer to the average consumer loan rates published by the Banque Centrale du Luxembourg.

Interest must be recorded at the end of the financial year and calculated following standard banking industry practices.

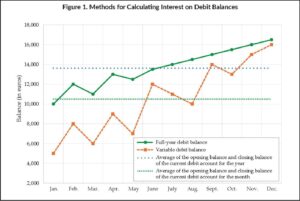

- If the current account remains in a debit position throughout the entire financial year, the applicable interest charge should be based on the arithmetic average of the opening and closing balances.

- If the debit current account did not exist for the entire duration of the financial year or if there were significant variations in the balances, the arithmetic average of the debit balances at the end of the different months should be considered.

The following graph illustrates the methods for calculating the interest on debt balances:

- The shareholder or partner is a related enterprise

For related enterprises, interest rates must comply with transfer pricing rules under Articles 56 and 56bis L.I.R., considering factors such as currency denomination, exchange rate risks, refinancing costs, and loan maturity.

Additionally, the provisions of Circular L.I.R./N.S. No. 164/1 (1993) remain applicable, particularly regarding the criteria for a repayable debit current account.[8]

To emphasize that debit current accounts must be structured as repayable loans, businesses must ensure that:

- A formal repayment obligation exists rather than an informal arrangement.

- Failure to repay may lead to reclassification as a hidden profit distribution.

- Even if the loan is deemed legitimate, non-payment of interest could still be taxed as a hidden distribution.

- Implications and risks for Businesses

Assess the legal and economic substance of shareholder and intra-group debit accounts

- Ensure that shareholder loans recorded as debit current accounts meet the criteria of a repayable loan, as outlined in Circular L.I.R./N.S. No. 164/1 of June 9, 1993.

- Verify that the debit current account represents an actual loan with a structured repayment schedule rather than an indirect dividend or hidden profit distribution.

Verify the presence of a formal loan agreement

- A repayable debit account should be supported by a written loan agreement, including:

- A fixed repayment schedule

- Agreed interest rate based on market conditions

- The company’s expectation of full repayment

- If no agreement exists, or repayment is not realistically expected, the account risks being recharacterized as a hidden profit distribution.

Ensure that interest is accrued and paid in line with market rates

- Interest must be determined in accordance with the specifications in section 1 and 2 of this section.

- Interest must be accrued properly to avoid the risk of tax adjustments.

- If interest is not regularly paid, tax authorities may consider the unpaid interest as a hidden distribution of profits.

Monitor repayment activity to avoid reclassification risks

- Regularly review debit current accounts to ensure that the repayment schedule is being followed.

- If repayment has been delayed or abandoned, the transaction may be retroactively reclassified as a distribution under Article 164, paragraph 3 of the Luxembourg Income Tax Law (L.I.R.).

Implement strong internal documentation to justify loan treatment

- Maintain detailed records of:

- The original loan agreement

- Interest payments and adjustments

- Any changes to the repayment schedule

- In case of a tax audit, these documents will help substantiate that the debit current account is a legitimate, repayable loan rather than a hidden profit distribution.

III. Conclusions

The introduction of Circular L.I.R. 164/1 (2025) represents a significant shift in Luxembourg’s transfer pricing landscape, particularly regarding shareholder and intra-group current accounts. The updated guidance reinforces the importance of market-based interest rate determination and proper transfer pricing documentation, emphasizing compliance with Articles 56 and 56bis L.I.R. and OECD guidelines.

Companies must ensure that intra-group financing arrangements adhere to the arm’s length principle and that shareholder debit current accounts are structured as repayable loans to avoid reclassification as hidden profit distributions. Failure to comply may result in tax reassessments, administrative penalties, and reputational risks.

A longer version of this article was originally published in the March 10, 2025, issue of Tax Notes International.

About the Author:

* Vanessa Ramos is the Managing Partner of TransFair Pricing Solutions (TFPS) and President of the Luxembourg Transfer Pricing Association. She is a transfer pricing and valuation expert with over 16 years of experience and she specializes in transfer pricing audit defense, advance pricing agreements, documentation, benchmarking, transfer pricing planning, and other economic compliance services.

The author may be contacted at: v.ramos@tfps.lu

Footnotes

[1] Circular L.I.R. 164/1, issued February 3, 2025, by the Luxembourg Tax Authorities. [2] Article 164(3) of the Luxembourg Income Tax Law (L.I.R.). [3] §171 of the Luxembourg Tax Code. [4] OECD Transfer Pricing Guidelines (2022). [5] §171 of the Luxembourg Tax Code. [6] §144 of the Luxembourg General Law on Taxation. [7] Circular L.I.R. 164/1, issued February 3, 2025, by the Luxembourg Tax Authorities. [8] Circular L.I.R./N.S. No. 164/1, issued June 9, 1993, by the Luxembourg Tax Authorities.