The deadline for filing the Country-by-Country (“CBC”) obligations is approaching and it is an opportunity to remember the basis of this compliance regulation as follows:

A. Background

On 13 December 2016, to ensure compliance with the BEPS Action Plan, the Luxembourg Parliament adopted Law of 23 December 2016 on Country-by-Country (“CBC”) reporting as one measure in connection with the automatic exchange of information (AEOI) for tax matters.

B. Scope

Multinational Enterprise (“MNE”) groups whose total consolidated turnover is higher than EUR 750 million during the fiscal year immediately falls within the scope of CBC.

C. Filing obligations

There are 2 types of annual CBC filing obligations:

- CBC notifications filed by all the Luxembourgish entities within the MNE Group to provide details on the role of the entity submitting the notification and identifies the entity

responsible to file the CBC Report (“Reporting entity”). - CBC report submitted by the Reporting entity for the MNE Group.

D. Deadline

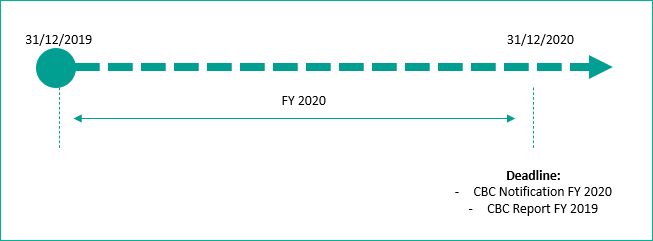

- Luxembourgish entities within the MNE Group must submit annually The CBC notifications no later than the last day of the reporting fiscal year 2020 for the MNE group.

- the Reporting entity must submit the CBC report no later than 12 months after the last day of the reporting fiscal year 2019 for the MNE group.

- Therefore, the deadline is approaching for taxpayers falling in CBC obligations:

E. Penalty

A penalty may apply up to EUR 250,000.00 because of:

- Fails or late filing of the CBC Report.

- Fail or late filing of the CBC Report notification.

- Files incomplete or inaccurate information.

F. How can we help?

TFPS with a dedicated and professional Transfer Pricing team can assist with the filing of CBC notifications and reviewing of the CBC reports in line with Luxembourgish CBC and OECD regulation. For more information make click here or get in touch with our team.