The application of the Directive on Administrative Cooperation (“DAC 6”) is approaching and it is important to be aware of the most important aspects of the coming new compliance regulation as follows:

A. Background

On 25 March 2020, the Luxembourg Parliament adopted the Law regarding the mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements

B. Scope

A reporting intermediary must transmit the information that is within its knowledge, possession, or control in connection with the reportable cross-border arrangements.

Where there is not intermediary and there is no other intermediary responsible for the reporting obligation, then it falls on the relevant taxpayer.

An intermediary has the possibility to prove by any means that the information has already been declared by another intermediary in the same Member State or in another Member State. The Luxembourg Tax Authorities (“LTA”) will make an assessment on a case-by-case basis, based on the facts and circumstances. A written document from the competent authority of the Member State concerned is one means of proof, among others. The sole indication of the arrangement ID will in principle not be considered sufficient. The proof is provided on request to the LTA.

In that context, it is important to understand the following definitions:

- Reporting intermediary:

- Any person who designs, markets, or organises a reportable cross-border arrangement, or makes it available for implementation or manages its implementation.

- A service provider qualifies as an intermediary if he knows or could be reasonably expected to know that he has undertaken to provide, directly or by means of other persons, aid, assistance or advice with respect to designing, marketing, organizing, making available for implementation or managing the implementation of a reportable cross-border arrangement.

- Relevant taxpayer: Any person to whom a reportable cross-border arrangement is made available for implementation, or who is ready to implement a reportable cross-border arrangement or has implemented the first step of such an arrangement.

- Reportable cross-border arrangement: any cross-border arrangement linked to one or more of the types of taxes referred to in article 1 of the law of 29 March 2013 on administrative cooperation in the field of taxation and which contains at least one of the hallmarks.

- Hallmarks: Characteristics or feature of a cross-border arrangement that indicates a potential risk of tax avoidance as listed below:

- Generic hallmarks linked to the main benefit test

- Specific hallmarks linked to the main benefit test

- Specific hallmarks related to cross-border transactions

- Specific hallmarks concerning automatic exchange of information and beneficial ownership

- Specific hallmarks concerning transfer pricing

C. Filing obligations

A reporting intermediary or relevant taxpayer must transmit the information related to an arrangement to the LTA by electronic filing on the secure state platform, MyGuichet, using:

- the manual entry through a specific process on MyGuichet or

- the drag and drop of a specific XML.

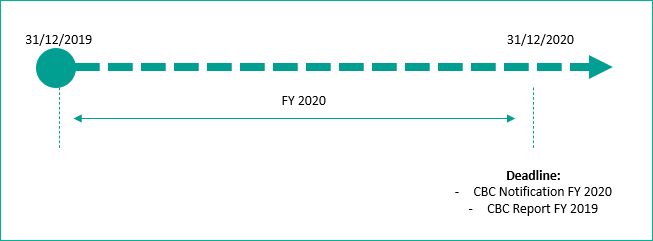

D. Deadlines

A reporting intermediary or relevant taxpayer must transmit the information related to the reportable cross-border arrangement according to its implementation date as follows:

- June 25, 2018 and June 30, 2020: the deadline is 28 February 2021.

- July 1, 2020 and December 31, 2020: the deadline is 30 January 2021.

- January 1, 2021 onwards: the deadline is 30 days.

E. Penalty

The intermediary or relevant taxpayer may be liable to a fine not exceeding EUR 250,000 because of:

- Failure to file information

- Late filing or filing of incomplete or inaccurate data

- Non-compliance by intermediaries.

The fine is set by the tax office for withholding tax on interest.